Solutions

Our Solutions Support Compliance Across a Range of Sectors

Our experts, powered by AI-driven solutions, help businesses efficiently navigate transfer pricing compliance obligations with accuracy and confidence. We provide robust solutions tailored to the needs of diverse industries.

“

Group Tax Manager

Industry-Wide Compliance Solutions

Consulting

Business Process Outsourcing (BPO), Engineering, Marketing

Consumer

E-commerce, FMCG, Wholesale, Retail

Energy & Natural Resources

Chemicals, Power Generation, Renewable Energy

Financial Services

Asset Management, Commodities Trading, Investment Banking, Real Estate, Fintech, Insurance

Infrastructure

Metals, Mining, Real Estate

Industrial

Automobiles, Aviation, Construction, Manufacturing

Logistics & Transportation

Logistics, Supply Chain Solutions, Transportation

Pharma & Healthcare

Biotechnology, Pharmaceuticals, Healthcare, Life Sciences

Technology

Consumer Electronics, Label and RFID Solutions, R&D, IT

Testing & Certification

Certification Services, Inspection, Testing

Solutions

TPIL Genetics™: Revolutionise Your Transfer Pricing Compliance

Experience seamless transfer pricing compliance with TPIL Genetics™, an intuitive, cloud-based AI-powered solution.

Designed to ensure consistency across policies, implementation, and documentation, TPIL Genetics™ enhances efficiency in routine tasks, improves data transparency, and fosters global collaboration. Our goal is to help you access the right information on time and establish sustainable compliance processes for the future.

Why Choose TPIL Genetics™?

Enhanced Collaboration

Scalable Framework

Build a future-proof compliance process that scales with your organisation’s needs.

Unified Compliance

Simplify complex transfer pricing processes and ensure alignment between policies, implementation, and documentation.

Decision Support

Cost & Resource Optimisation

Reduce compliance costs by minimising reliance on external consultants. Automate repetitive tasks to improve efficiency and accuracy.

Regulatory Adaptability & Risk Mitigation

TPIL Genetics™ Capabilities

TP Calendar

Data Collection & Storage

Transaction Values

Benchmarking

Documentation

TP Forms

Policy Implementation

BEPS 2.0 Compliance

Additional Features

- Draft, track, and execute intercompany agreements;

- Built-in, up-to-date TP news feed;

- Global transfer pricing regulation summaries;

- Machine translation for Local Files and Master Files (50+ languages);

- Accessible via desktop or tablet with two-way authentication & optional SSO sign-in;

- Customisable management and user access roles;

- Dedicated Client Support Team for prompt assistance

Solutions

TPI BEPSXpert™

Simplified. Automated. Integrated.

Automate compliance with our intelligent transfer pricing solutions — seamless integration, faster calculations, and complete audit readiness.

Automated Validation & Calculation

TPI BEPSXpert™ streamlines Amount B determination with a structured, system-driven 4-step process.

Qualify

The system guides users through a qualifying questionnaire to determine eligibility for Amount B.

Compute

Validate

Report

Knowledge Management & Automated Compliance

- Comprehensive Knowledge Hub

Access an extensive library of resources, including key definitions, global tax terminologies, blogs, recent regulatory updates, and a heatmap tracking evolving global tax frameworks.

- Interactive Learning Tools

- Real-Time Updates

Pillar II Compliance

Simplified with TPI BEPSXpert™

TPI BEPSXpert™ automates the entire Pillar II compliance process, reducing manual effort and ensuring full regulatory alignment.

1

Import & Validate Data

- Automatically detect, map, and verify data based on predefined rules and built-in checks

2

Build a Comprehensive Data Model

- Standardise and structure key data across entities and jurisdictions.

3

Advanced Calculation & Reporting

- Customise tax & safe harbour calculations with dynamic formula design.

- Present results in interactive formats.

4

Ensure Seamless Versioning

- Track full version history for audit compliance.

5

Automate Report Generation & Compliance

- Generate audit-ready reports with seamless integration into the GIR module.

- Ensure real-time data synchronisation for accurate reporting.

Pillar II Compliance

Simplified with TPI BEPSXpert™

TPI BEPSXpert™ automates the entire Pillar II compliance process, reducing manual effort and ensuring full regulatory alignment.

Advanced Calculation & Reporting

- Present results in interactive formats.

- Customise tax & safe harbour calculations with dynamic formula design.

3

Build a Comprehensive Data Model

2

- Standardise and structure key data across entities and jurisdictions.

4

Ensure Seamless Versioning

- Track full version history for audit compliance.

Import & Validate Data

1

- Automatically detect, map, and verify data based on predefined rules and built-in checks

5

Automate Report Generation & Compliance

- Generate audit-ready reports with seamless integration into the GIR module.

- Ensure real-time data synchronisation for accurate reporting.

Ready to Transform Your Pillar II Compliance?

Discover how TPI BEPSXpert™ can simplify, automate, and integrate your compliance processes. Contact us today for a demo.

Solutions

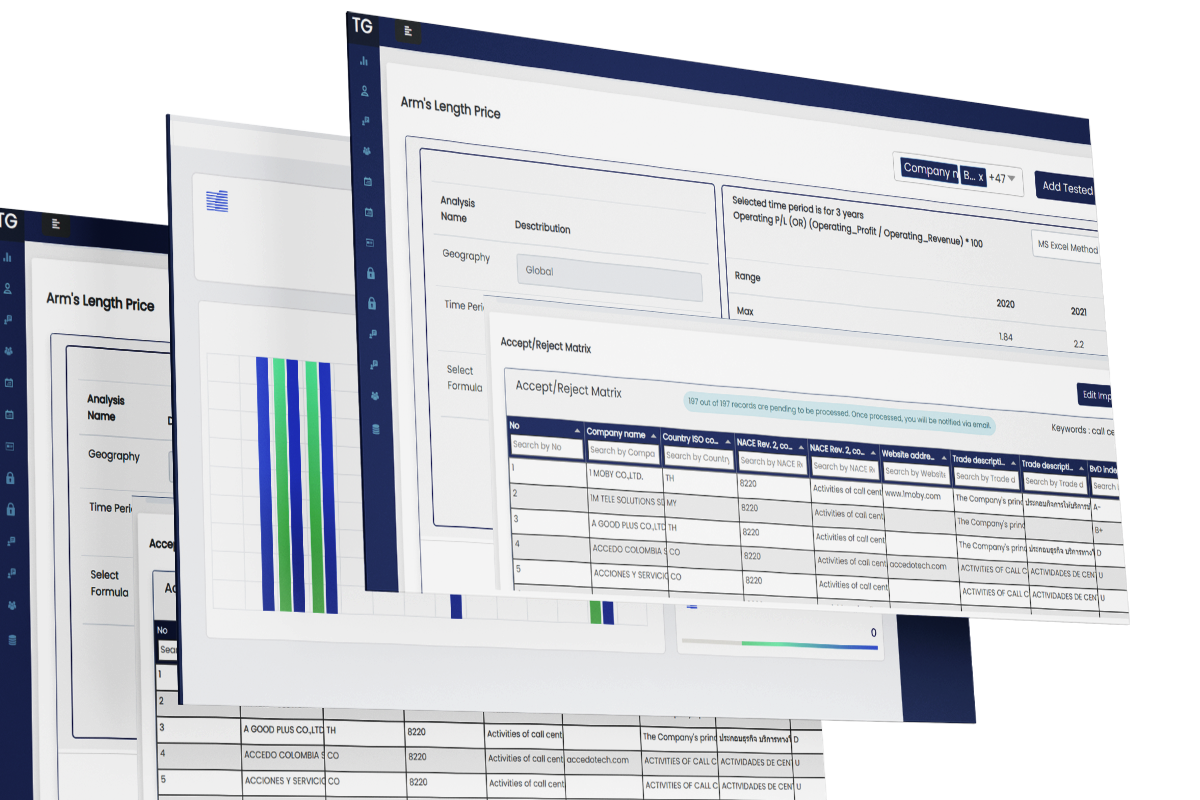

TPI GenQuantum™

AI-Powered Transfer Pricing Benchmark

Transform Your Benchmarking Process & Save Up to 70% of Preparation Time

TPI GenQuantum™ revolutionises transfer pricing benchmarking by leveraging AI to instantly process large volumes of data, enabling deeper insights and informed decision-making. With end-to-end automation, a verified comparables repository, and seamless reporting capabilities, TPI GenQuantum™ ensures efficiency, accuracy, and compliance in benchmarking processes.

Export Benchmark Results in Multiple Formats

Automated Comparable Screening

One-Click Local File Integration

Automated Profit Margin Computation

Custom Benchmark Report Generation

Arm’s Length Validation

1

Automated Comparable Screening

2

Automated Profit Margin Computation

3

Arm’s Length Validation

4

Custom Benchmark Report Generation

5

One-Click Local File Integration

6

Export Benchmark Results in Multiple Formats

Ready to Revolutionise Your Benchmarking Process?

Discover how TPI GenQuantum™ can transform your transfer pricing compliance. Contact us today for a demo!

Solutions

TP Brazil™

Optimise TP Positions Regarding Brazilian Specificities

TP Brazil™ remains a powerful tool for remains a powerful tool for compliance analysis, reviews, audit defence, and optimising historical transfer pricing positions based on pre-2024 and, also, current, and future regulations, concerning the local specificities.

Key capabilities include:

- Accurate transfer pricing calculations aligned with Brazilian regulations in force.

- Comprehensive management reports for audits, reconciliations, and internal data analysis.

- Automatic filling of ECF forms to streamline compliance and reporting.

- Retrospective and prospective compliance monitoring to assess pricing adjustments and safe harbours.

- Ongoing price planning to eliminate potential transfer pricing adjustments.

- Risk mitigation strategies to reduce tax contingencies related to transfer pricing rules.

- Audit defence support with automated calculations and structured reporting.

TP Brazil™ is constantly updated and remains an essential resource for calculation, data validation, risk assessment, and strategic adjustments to past, current and future transfer pricing positions in Brazil.

ISO 27001 Certification

Work with confidence, knowing an ISO 27001-certified partner protects your data. Our commitment to information security best practices ensures the confidentiality, integrity, and availability of your business-critical data. Through structured risk management and continuous improvement, we help safeguard your information while ensuring compliance with global security standards.